Table of Contents

When investing in company shares and owning bonds, investors expect a positive long-term return after inflation. Sadly, it is inevitable that market returns in the short run are not predictable. They are filled with noise as the market incorporates new information into prices. Global interest rates rose quickly in 2022 as a result of high inflation, which partially accounted for the decline in global bond and equity prices. It served as a harsh wake-up call that there are often bumps and hard detours on the path to long-term returns. With higher yields, investors may have been attracted to hold onto more cash, but it would have been an unwise short-term decision. It is almost always a poor choice for those with long investment goals. Thankfully, the tale of 2023 has been quite encouraging.

Looking backwards

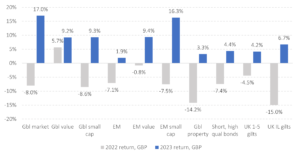

Every one of the main asset classes achieved a positive return last year. The US market recovered the losses it sustained in 2022, especially the “Magnificent Seven,” as the media has named the major tech companies. Their contributions accounted for almost 75% of the US market’s annual return. Because the US accounts for roughly 63% of global markets, the result was strong returns for developed markets worldwide. Because of the “Magnificent Seven’s” enormous influence, value companies underperformed in the US but significantly contributed elsewhere. In emerging markets, value and smaller businesses performed strongly. Global commercial property (REITs) saw strong returns as well.

High-quality, short-dated bonds have recovered more than half of the losses experienced in 2022 on the defensive side of portfolios. This is mostly due to the higher bond yields that caused the pain in 2022. The returns on these bonds are similar to those of cash.

Figure 1: Global investment returns – 2022 and 2023 compared

Data: Funds used to represent asset classes, in GBP. See endnote for details.

In 2023, prudent, systematic portfolios consisting of a diversified “growth” basket of equities, with tilts to value and smaller companies, combined with “defensive” short-term, high-quality bonds, should have produced strong returns, approximately 9% for a 60/40 split in GBP terms[1]. Over the year, investors holding portfolios denominated in GBP experienced a slight currency drag as Sterling and the majority of other major currencies appreciated against the US dollar by approximately 4%. In November, the UK’s annual inflation rate decreased from 10.5% at the beginning of the year to 3.9%.

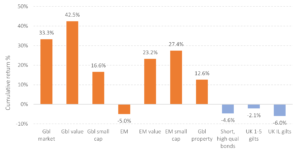

Examining cumulative returns over three years aids in demonstrating the advantages of staying invested during challenging times like 2022. Due to initial yields of almost 0% at the beginning of the era, followed by successive yield rises (and consequently bond price decreases), bond returns have been weak; nevertheless, these have been more than offset by strong growth asset returns.

Figure 2: Cumulative global investment returns – three years to the end of 2023

Data: Funds used to represent asset classes, in GBP. See endnote for details.

Looking forwards

The major economies, including the UK, are teetering on the verge of recession, making the outlook for the global economy a little dim. China’s prospects for growth are being hindered by a wide range of profound economic issues. Inflation has fallen from previous double-digit highs in the EU (2.4%), the United States (3.1%), and the United Kingdom (3.9%). There are still hazards, such as the Middle East crisis affecting supply chains and energy, and it will be more difficult to accomplish the tasks that remain to attain the central bank’s inflation rate goal of 2% in the UK due to geopolitical concerns. Interest rates may remain elevated relative to the low rates enjoyed by investors until early 2022, which is favourable for bondholders.

It is helpful to keep in mind that prices today already take into account perspectives for the future. No one knows what will happen next. The secret is to stay diversified, unwavering in the face of market setbacks and focused on your long-term goals.

And finally…

In a broader sense, Putin is still waging an unlawful and violent war in Ukraine, and there doesn’t appear to be any end in sight to the terrible humanitarian catastrophe that is occurring in Gaza. All of the innocent individuals entangled in these wars are on our minds.

Elections in democracies like the US, UK, Taiwan, India, Pakistan, Indonesia, and the European Union are expected this year. There is a great deal of uncertainty about the future since US politics are as partisan as they have ever been. The democratic process is frequently disorganized, confrontational, and even unsettling. Hopefully, the governments that emerge from these elections will grant Abraham Lincoln’s request, which he expressed in his Gettysburg Address following the Battle of Gettysburg in 1863:

‘that these dead shall not have died in vain—that this nation, under God, shall have a new birth of freedom—and that government of the people, by the people, for the people, shall not perish from the earth.’

The Conservatives in the UK may find it difficult to hold onto power. As Churchill famously stated:

‘Many forms of Government have been tried and will be tried in this world of sin and woe. No one pretends that democracy is perfect or all-wise. Indeed it has been said that democracy is the worst form of Government except for all those other forms that have been tried from time to time.…’

Winston S Churchill, 11 November 1947

On a more positive side, it is important to keep in mind that, despite global conflicts, seeming discord in democratic countries, and the emergence of autocratic governments, our world is better now than it has ever been. Although 659 million people worldwide live in poverty, this is a decrease from 902 million in 2012 and 1.9 billion in 1990[2]. Since 2000, 2.1 billion people have received access to safe drinking water, and women now hold 40% of board seats in FTSE 350 businesses. Ten years ago, only about 150 of these companies had any female board members[3]. Additionally, there has been a 60% decrease in under-5 mortality worldwide.

These lesser-known facts provide a very constructive counterweight to the current global issues.

As investors, we continue to hope for the best in 2024, but we also continue to be prepared to face the worst, as is always wise.

Happy New Year – From the Private Capital Team

Other blog posts you may find interesting:

Continue your search with other blogs below:

Risk Warnings:

The information, including but not limited to, text, graphics and other material contained in this article is for informational purposes only and does not necessarily reflect the views of Private Capital Limited. The purpose of this article is to promote a broader understanding, knowledge and awareness of various financial, behavioural and economic topics. It is not intended to be a substitute for regulated professional investment advice. Always seek the advice of a regulated financial adviser with any questions you may have regarding your specific investment needs or concerns.

Private Capital Limited does not recommend or endorse any strategies or ideas mentioned in these articles. Reliance on any information appearing in this email is solely at your own risk.

Past performance is not indicative of future results and no representation is made that the stated results will be replicated.

[1] Refer to the table in the endnote for underlying funds and allocations. This is provided for informational insight only and does not represent any form of advice or recommendation.

[2] https://borgenproject.org/victories-fighting-poverty/

[3] Sunday Times magazine, December 31, 2023. ‘Really, actually, properly excellent things that happened in 2023’