Blog

Blog

Your 7-point Mid-Year Financial Plan

Table of Contents 1. Check your cash flow2. Review your debt balances …

Published :

Updated :

Read moreUnderstanding the Concepts of Distribution and Accumulation in Investment Funds

Table of Contents Pros and Cons of Distribution FundsPros and Cons of Accumulation Funds…

Published :

Updated :

Read moreOvertrading can be the downfall to your investment returns

Table of Contents Patience is a virtueThe damage of overtradingThe psychology…

Published :

Updated :

Read moreHow The Emotional Gap Affects Investments in Hong Kong

Table of Contents Understanding the Emotional GapStrategies to Mitigate Emotional Biases In the realm of finance,…

Published :

Updated :

Read moreUnravelling Mutual Funds, ETFs and Index Funds

Table of Contents Understanding Mutual FundsGrasping Exchange-Traded Funds (ETFs)Decoding Index Funds…

Published :

Updated :

Read moreHow financial planners can help manage your expectations on the return on your investments

Table of Contents Dispelling the 10% MythRealistic Expectations: Balancing Risk and Return…

Published :

Updated :

Read moreTaking the Easy Wins

Table of Contents Are there pension/tax planning opportunities in Hong Kong?Should I…

Published :

Updated :

Read moreChoosing the Right Path: Evaluating Irish-Domiciled Funds and US-Listed Funds

Table of Contents Taxes when holding ETFsAcross the pond: Buying Ireland-Domiciled ETFs…

Published :

Updated :

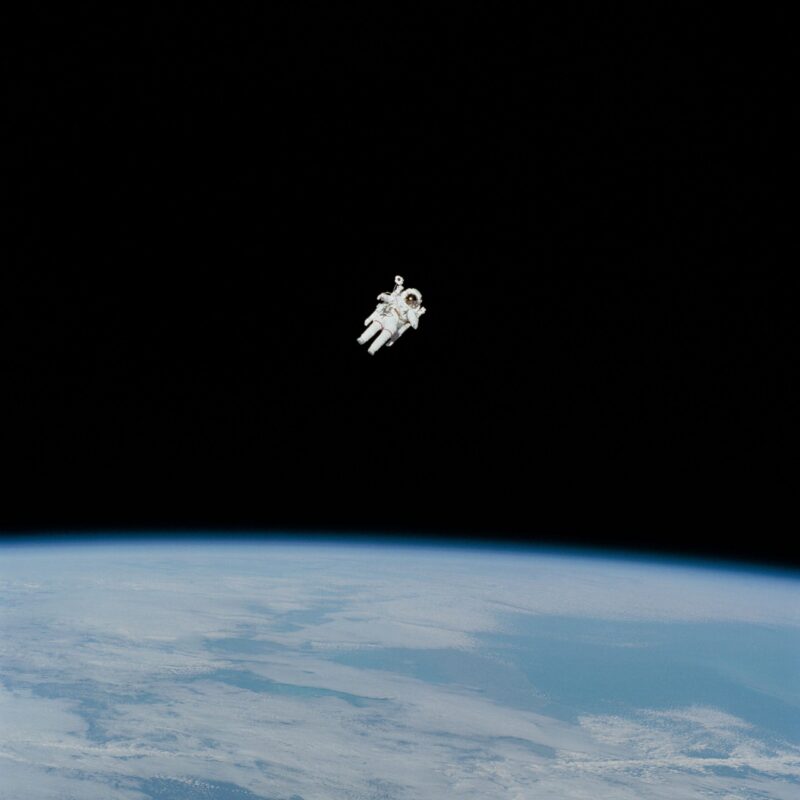

Read moreWhy Fee-Based Financial Advisors Warn Against Short-Term Investing Focus

Table of Contents The Allure of Short-Term GainsConsequences of Short-Term Thinking…

Published :

Updated :

Read moreA Guide to Spring Clean Your Finances

The Japanese kanji for crisis (above) comprises two symbols: one representing danger and the other ‘opportunity.’ Our busy clients often lamented that they never had time to focus on their finances. However, during the COVID-19 pandemic, we witnessed a surge…

Published :

Updated :

Read moreThe Great Debate: Stocks or Bonds? Making Sense of Your Investment Choices

Table of Contents I. Stocks and Bonds: Unveiling the Investment GiantsII.

Published :

Updated :

Read moreHow to Perform Due Diligence on a Financial Advisor

Table of Contents What is a Fiduciary Advisor?Compensation Structures of Financial Advisors…

Published :

Updated :

Read more