Most investors most likely wish to forget about the dismal results of bonds and stocks in 2022 and the first part of 2023. Many investors were seeing bonds declining in value for the first time, especially since equities were rising at the same time. Depending on the kind of bonds they held, various investors would have had varied experiences in 2022 (and thereafter). Examining what has transpired since then is worthwhile.

Taking a look back at the fundamentals, we can see that bonds have the following characteristics: bond prices move in the opposite direction of bond yields, meaning that when yields rise, bond prices fall; bonds with longer maturities are more volatile than bonds with shorter maturities because they are more sensitive to yield changes; bonds with lower quality issuers behave more like equities; and finally, bond markets dislike inflation, which is why they typically raise yields in response to rising inflation.

Bond yields increased significantly in 2022 as a result of the growing risk of high inflation brought on by Russia’s invasion of Ukraine and the instability of the Conservative administration under Liz Truss’s unfulfilled tax promises. The bond market fluctuated sharply, causing large and excruciating value declines for bondholders with longer maturities. Bondholders with shorter maturities fared better, although they nonetheless saw value declines. However, bondholders started to reap the rewards of the increased yields their bonds now yielded, partially recovering those value declines.

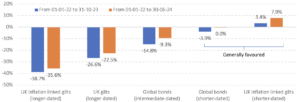

Examine the following graphic to see how much bonds dropped for various maturities and the cumulative return from the fall’s beginning. As can be seen, longer-dated bonds remain significantly underwater while shorter-dated bonds have experienced a significant bond bounce-back, returning to their initial level.

Figure 1: Bond falls and recoveries vary depending on what you own

Source: Morningstar Direct © All rights reserved – see endnote for details.

Shorter-dated bonds have recovered significantly faster than longer-dated bonds because the former’s price decline was less severe and the higher yields that followed helped to at least partially offset these declines in nominal, pre-inflation terms. In 2022, shorter-dated global bonds saw an about -7% decline at their lowest point. They did, however, deliver somewhat more than +5% in 2023 and roughly +1% through the end of June this year due to minor yield increases in all the major markets.

For this reason, we have always favoured shorter-dated bonds since we feel that the downside protection and bounce-back potential of owning shorter-dated bonds outweigh the slight premium associated with lending for a longer period.