Table of Contents

Our last blog discussed the merits of having a clear, well-thought-out financial plan. Once you have a plan in place, we recommended in our guide looking at some other areas which are “easy wins” in terms of effort vs reward.

As Financial Planners in Hong Kong, there are a couple of exercises we recommend to our clients and connections which are well worth taking some time out to complete on a Sunday morning with a cup of coffee in hand.

Are there pension/tax planning opportunities in Hong Kong?

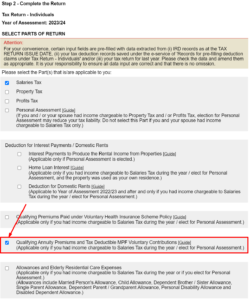

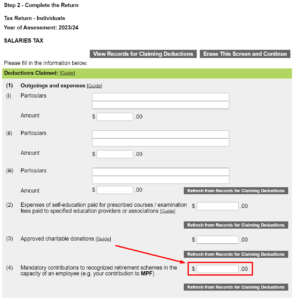

It’s that time of year when most of us have already had our Hong Kong tax return. Don’t forget that you can add in up to $18,000 of MPF contributions which will receive tax relief when your bill comes later in the year:

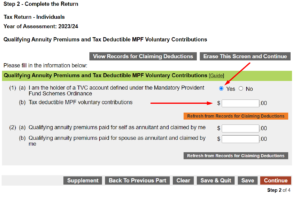

The Hong Kong government has offered some encouragement to save by way of additional tax relief, something we feel has been lacking. In our opinion, making the most of the relatively new Tax Deductible Voluntary Contributions (TDVC) should be a must for all who can afford it. Paying the maximum of HK$5,000 per month (HK$60,000 per year) will reduce your tax bill by up to HK$10,200.

As with the MPF, don’t forget to claim on your Tax return to get the relief if you made contributions in 2023/24:

If you haven’t yet set this up, get in touch with your MPF provider or HR department who should be able to help. Alternatively, get in touch if you need us to help point you in the right direction.

Should I pay National Insurance Contributions abroad?

This is a common question in expat circles in Hong Kong, which gets asked frequently. The answer is “Yes!”.

Mat Bate covered this in a previous post on our website, but we will recap the basics.

Whilst offshore you can continue paying contributions to increase the number of “qualifying years” you have towards the new state pension, the maximum being 35.

Log on to https://www.gov.uk/check-state-pension to check how many you’ve currently accrued and see if there are any years you missed that you may be able to pay backdated contributions. You can then complete the form CF83 to initiate a direct debit to begin paying contributions. Currently, class 2 contributions cost £3.45 per week.

The maximum new state pension is currently £10,600.20 per year per individual and could therefore provide a British couple with over £21,000 of inflation-linked income in retirement.

Could you get a cheaper mortgage?

Interest rates are historically low, presenting opportunities for new and existing borrowers. If you have been thinking about buying property, now could be a good time to lock in a low interest rate on a mortgage. If you are an existing homeowner, get in touch with your lender to see if there are any better deals to be had, or speak to a broker who could help you search the market to see if you can reduce your monthly outgoings.

As always, there are lots of considerations when buying property, not least the multitude of taxes to navigate, especially for buyers of UK homes. Capital gains tax, income tax, and inheritance tax should all be considered before making a final decision. Although not tax advisers, at Private Capital we are all UK-qualified and can therefore guide what exposure you may have to UK tax as a Hong Kong resident.

Ensure your loved ones are protected.

We recently discussed wills and guardianship, a critical topic which resonated with a lot of clients. One of the other foundations of financial planning is protection. Do you have peace of mind that if some bad news came about, your family would be well taken care of?

Now is a great time to review the benefits you are entitled to through your employer. Many provide death in service lump sums which are normally a multiple of salary. These can vary greatly between 2 and 10 times so you must be aware of what your family will receive.

After establishing this you can work with a financial planner to determine whether you need to take out additional coverage on a personal basis. Your employment-related benefits are just that; employment-related, so if you leave, move, or lose your job, you lose the benefit. Some clients, therefore, prefer to treat these as a bonus and ensure their liabilities are taken care of personally, regardless of employment status.

We typically recommend clients to cover their liabilities up to retirement age assuming the complete loss of income. This would include ongoing living costs, mortgage debt, education funding, and retirement savings.

Contact us if you’d like to run some quotes; we can offer insurance through our subsidiary company, PCL Insurance Services.

Next Steps

Hopefully, these are a few areas where you can quickly make some hugely positive steps forward in your financial planning which will be incredibly rewarding to your future self.

In another blog post, we take a look at Estate Planning which should be a key consideration for British expats in Hong Kong. We find there is often confusion around who is liable for it and the fact that inheritance tax is one of the most punitive at 40% makes it worth getting clarification around your planning opportunities.

If you would like more information on any topics covered, get in touch with one of the team who will be more than happy to help.

Other blog posts you may find interesting:

- Should I pay National Insurance Contributions whilst residing in Hong Kong?

- Financial Plan

- Estate Planning

Continue your search with other blogs below: