Most human beings find it difficult to be investors. We’re brought up to try and purchase items when they are cheap and avoid them when they are considered expensive, however, the data suggests this is often not the case for equities. When markets are heading north and accounts are showing positive returns, investors tend to be overly confident, and enthusiastic, often choosing these times to add to their holdings. Conversely, when markets drop, they induce feelings of caution and fear, we are hesitant to add to our portfolios and even consider selling equities to avoid potential further falls in value. If you do not require access to your capital in the foreseeable future, this is rarely a good move.

Private Capital rebalances our client portfolios on an annual basis, which means we place trades to return all funds in the portfolios to their original target allocation. During a growth period, this involves selling growth assets (equities) and buying defensive assets (bonds) to ensure the portfolio remains within your agreed risk tolerance, protecting it from falls in line with your capacity for loss whilst maintaining the exposure to the market to fulfil your need to take on risk in the first place.

Logically, during “the bad times” such as we are experiencing now, the opposite applies; the proportion of growth assets in the portfolio will have fallen below the intended target allocation, and therefore overall you are taking on too little risk, making it harder for those assets to recoup the falls during the market recovery.

Using a simple example: Let’s assume you own a $100,000 portfolio split equally between growth assets ($50,000) and defensive assets ($50,000). Within this, you own 500 units of a World Equity fund priced at $100 per unit. This fund then falls 40% due to one or more market events whilst your well-chosen, high-quality defensive assets, are unchanged in value. You still have your 500 World Equity fund units, but they are now priced at $60 (total value now $30,000). Your portfolio is now split 37.5%/62.5% rather than the original 50%/50%; Time to rebalance.

Figure 1: Market falls leave you underweight growth assets

Source: Albion Strategic Consulting

Rebalancing, in this case buying equities to return the portfolio to its allocation target, helps to speed up the recovery to the starting point. This is because buying more equities at a lower price reduces the price needed to get back to the breakeven point.

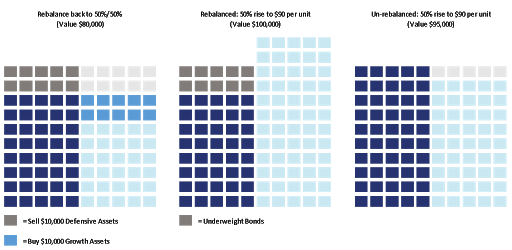

In practice, we first sell $10,000 of your defensive assets, and with the $10,000 raised, buy 167 units of the Equity fund at $60 per unit (left-hand grid). To get your portfolio back to the $100,000 start value, your 667 global equity units need only to rise 50% to $90 per unit (middle grid). If you took no action (un-rebalanced portfolio right-hand grid), this 50% rise would only bring the portfolio value to $95,000. The un-rebalanced portfolio would require a rise of 67% in the global equity units back to $100 to get back to the $100,000 starting value.

Figure 2: Rebalancing helps the portfolio to recover faster

Source: Albion Strategic Consulting

If markets were to fall again after your portfolio was rebalanced, the opportunity exists to rebalance again, further reducing the rate of return required to get back to where you were compared to un-rebalanced portfolios. This takes courage and discipline when your gut is likely telling you to do the opposite.

If you are drawing an income from your portfolio, taking the withdrawal from your defensive assets will bring you closer to your target. Similarly, if you receive an income, this could be used to buy more growth assets.

As David Swensen, CIO of Yale University’s Endowment and one of the world’s most highly respected institutional investors states:

“The fundamental purpose of rebalancing lies in controlling risk, not enhancing returns. Rebalancing trades keep portfolios at long-term policy targets by reversing deviations resulting from asset class performance differentials. Disciplined rebalancing activity requires a strong stomach and serious staying power.”

Private Capital acts as fiduciary financial advisors to predominantly expat clients. As we have discretionary management rights to our client’s accounts, we can act upon these market movements promptly to ensure a rebalancing event is as efficient as possible.

As ever, please feel free to contact us if you have any questions.

Other blog posts you may find interesting:

- What You Should Do in Response to Market Volatility

- Waiting for the storm to pass

- Who packed your parachute

Continue your search with other blogs below: