Table of Contents

The investment management world adores legends, none more so than the nonagenarian ‘Oracle of Omaha’ Warren Buffett, CEO of the US-listed firm Berkshire Hathaway. Buffett has developed a portfolio of directly holding companies in addition to a portfolio of listed stocks. He is currently the fifth-richest individual in the world with a net worth of over $100 billion. He is widely regarded as a highly successful investor and frequently used as an example to encourage an active, judgmental approach to investing.

Contrarily, Warren Buffett’s famous status as an active investor offers some valuable lessons that support using a low-cost, systematic approach to investing.

Lesson 1: Believe in the power of capitalism and compounding over time

Buffet is aware of capitalism’s potential to generate significant wealth. He began investing when he was 11 years old in 1941, and as of the age of 92, he has amassed almost 80 years of compounding returns from primarily US-based businesses he has acquired. At 39 years old, he had a net worth of $25 million. His biography is remarkable[1].

‘The genius of the American economy, our emphasis on a meritocracy and a market system and a rule of law has enabled generation after generation to live better than their parents did.’

Lesson 2: Patience and emotional fortitude are key

Like an index fund, Buffet intends to hold the companies for the long term.

‘Our favorite holding period is forever’

In response to short-term market pressures, such as the subpar relative performance of value stocks from 2018 to 2020 or equities market declines, he refrains from making decisions that are prompted by emotions.

‘The most important quality for an investor is temperament, not intellect.’

Lesson 3: Active management is not easy

Despite his extraordinary business expertise and excellent track record, it is difficult to outperform the market over the long term. He has always been an avid value-oriented investor and attracted attention in the years leading up to the 2000–2003 tech crash by stating he did not get it. He was partially shown to be correct. Finding deals that would significantly improve performance has gotten difficult as Berkshire has expanded. He spent his formative years searching for unique investment opportunities. In those post-World War years, information was limited, professional investors made up a far smaller portion of the investor base, and markets were presumably less efficient. Would he succeed as well if he were beginning today? Who is to say? Herein is the problem.

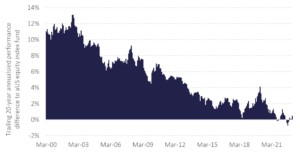

Look at the graph below, which compares Berkshire’s performance relative to a US equity index fund across 20-year rolling periods. The early years’ enormous prosperity gave way to much harder times. Investing in an S&P 500 index fund would have yielded almost the same return over the past 20 years.

Figure 1: Buffet’s alpha – it is not so easy to win anymore

Source: Berkshire Hathaway Inc Class A, Vanguard 500 Index Investor Fund (VFINX) USD. Morningstar Direct © (see endnote)

Lesson 4: You need an investment approach for your lifetime

Despite his legendary status, Warren Buffett is not indestructible. At 92, Warren Buffett’s tenure at Berkshire Hathaway is nearing its end. Will his successor be able to produce returns that outperform the market? What impact would Berkshire’s sector-skewed, and US-centric focused concentrated portfolio of businesses have on performance? Will it miss out on some of the – as of yet unidentified – potential global winners of the future? Simply by buying a well-diversified index fund, you can escape this conundrum. Buffett agrees.

‘The goal of the nonprofessional should not be to pick winners – neither he nor his ‘helpers’ can do that – but should rather be to own a cross section of businesses that in aggregate are bound to do well.’

‘Consistently buy an S&P 500 low-cost index fund. I think it’s the thing that makes the most sense practically all of the time.’

Lesson 5: Humility and using wealth well

His humility both as a person and as a way of life is a contributing factor to his legendary status. He doesn’t need a superyacht, a private jet, or numerous properties. He still resides at the Nebraska home he purchased in 1958, consumes McDonald’s burgers, consumes See’s Candies, and notoriously drinks Coke. When he passes away, he plans to give away all of his fortune, with 85% going to the Bill and Melinda Gates Foundation. He stated:

‘I don’t have a use for the money. It just makes you feel good to do it.’

That might be his most valuable message of all.

Other blog posts you may find interesting:

Continue your search with other blogs below:

Risk warnings

This article is distributed for educational purposes and should not be considered investment advice or an offer of any security for sale. This article contains the opinions of the author but not necessarily the Firm and does not represent a recommendation of any particular security, strategy or investment product. Information contained herein has been obtained from sources believed to be reliable but is not guaranteed.

Past performance is not indicative of future results and no representation is made that the stated results will be replicated.

[1] Read this article if you are interested. https://www.thebalancemoney.com/warren-buffett-timeline-35643