Table of Contents

This time we look at Estate Planning; we’ve discussed in a previous blog the importance of having your Will and Deed of Guardianship set up, so if you haven’t yet read and acted upon that, make it a priority. Here we focus on taxation for those with a UK connection either presently or expected in the future.

Resident or Domiciled?

Many people confuse Residence and Domicile and, unsurprisingly, a 2017 study showed that whilst 74% of British expats considered themselves to be non-UK domiciled, many still hold assets in the UK and over 80% have not ruled out returning to the UK at some point in the future. Without going into detail on this complex matter, these individuals are highly likely to still be considered UK domiciled by the HMRC.

Residence defines where you currently live and pay income tax on your earnings from employment or business profits, it can also determine what income tax and capital gains tax you pay on investments. Some jurisdictions, such as Hong Kong, have favourable tax regimes whereby you are only taxed on locally sourced income, and can therefore earn and receive foreign income and gains back into your bank account with nothing taken off.

If referring to the UK, Domicile is the concept that determines whether your estate will be subject to inheritance tax on death. It can also have a bearing on which assets you pay income tax and capital gains tax for those who are, or become, UK residents in the future. Most UK-domiciled individuals were born in the UK to a UK-domiciled father thus acquiring a Domicile of Origin in the UK which never leaves your side.

It is possible to change your domicile, but this is not easy and would involve cutting all ties with the UK and, most importantly, requiring you to reside in the place you want to spend the rest of your days. We find a lot of people in Hong Kong do not intend to retire here, thus their UK domicile of origin remains until they move on.

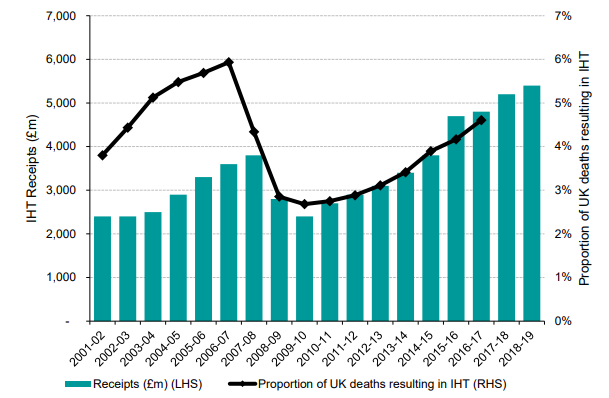

Knowing the difference between residence and domicile is important; in the UK around £220 million of cash and other assets are inherited daily, and inheritance tax (IHT) receipts in 2018/19 were £5.36 billion.

Regardless of residence, UK-domiciled individuals are subject to IHT on their worldwide assets, and non-UK domiciles are charged on all UK-based assets including Physical Property. There are various exemptions and reliefs (the first £325,000 of your estate is taxed at 0%) available but they have to be claimed/made use of and often can involve giving up access to your capital.

Assuming Roy Jenkins’ quote does not apply to you, you could gift all of your assets to your beneficiaries whilst still alive. There are various anti-avoidance rules in place to limit the effectiveness of this exercise, especially if you plan to have further enjoyment of the gifts (e.g. continuing to live in the family home now owned by your children).

Moving to the UK?

If you’re thinking of returning or moving to the UK, what are the steps you should take to ensure you don’t get hit with an unexpected or avoidable tax bill?

For UK domiciles, once you become a UK resident in the UK, you have no choice but to be subject to full taxation on all worldwide income and gains from day 1 of residence. Therefore, before moving, one should crystallise any gains on investment accounts and perhaps property owned outside of the UK to avoid having to pay up to 28% (for 40% of taxpayers) capital gains tax on the growth.

For non-domiciled persons moving to the UK, the same rules apply; once resident you will be subject to full UK tax on all income and gains remitted to the UK. The rules around remittance are very complicated and professional advice should always be sought well in advance of relocation. If you or anyone you know is planning a move to the UK, we would urge you to get in touch with us to discuss the implications and help plan the move as early as possible.

After 15 years of UK residence, non-domiciles no longer have any way to escape worldwide taxation and are also caught in the IHT net, subjecting their heirs to a 40% tax on death.

What planning steps can be taken?

We mentioned before that there are several anti-avoidance rules in place, there are however several legitimate planning options available to both UK and Non-UK domiciles.

Outside of gifting, there are some financial arrangements that offer tax efficiency for IHT as well as both income and capital gains tax, such as pension schemes which in most cases would reside outside of your estate.

For a lot of client circumstances, trusts can also be an excellent solution and they do not have to be complicated and expensive to use as is often the expectation. For Non-UK domiciled individuals in particular, an offshore trust can offer full sheltering from UK inheritance tax for life, even if acquiring UK domicile status by way of staying for 15 years.

If you would like to know more, please do get in touch and, as always, feel free to share especially if you know anyone who is thinking of moving to the UK in the near or distant future. Mistakes made during this process can be extremely costly.

Other blog posts you may find interesting:

Continue your search with other blogs below: