It’s straightforward to say that choosing to invest, to begin with, gives a chance to safeguard hard-earned money from inflation and even increase it further. Having the foresight and self-control to refrain from spending money now to have a better tomorrow is not simple, though. Determining one’s potential need, want, and ability to participate in the stock market to assist future expenditure is a difficult task. It’s important to get this correct, and here is where fiduciary financial advisors can help.

It is a fact that stock markets are a primary source of return in an investor’s portfolio. The global market structure, which provides broad diversification and establishes the fundamental nation, sector, and business weights, is a smart place to start when investing in stocks.

It’s also a given that superior bonds moderate returns and provide security against market fluctuations.

To understand what kinds of long-term investments usually enhance a portfolio’s structure, it might be challenging to know what evidence to search for. This results from the necessity of gradually developing an awareness of the hazards to which one wishes to be exposed.

Determining which bonds are judged defensive enough to be regarded as an insurance policy against the inherent instability in stock markets is likewise a difficult task.

Lastly, the idea is straightforward: investors have a higher probability of accomplishing their investment objectives with a low-cost fund that is designed to capture the target approach than with a high-cost one.

But it is not simple to comprehend the trade-off between a fund’s management costs and the opportunity cost (i.e., what could have been) of skipping an investment, or routinely searching for which funds would be best positioned to capture the returns of each segment of the market. Even more difficult is putting in place a comprehensive and ongoing mechanism for investment oversight, which is necessary to keep the strategy credible.

Figure 1: Investing can be simple, but that does not mean it is easy to do

Source: Albion Strategic Consulting

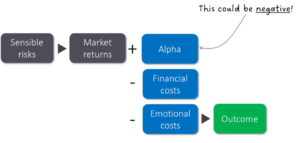

To explain what we anticipate from an investment outcome, we can have a look at a simple equation displayed in the image below.

Figure 2: A simple formula to describe an investing outcome

Source: Albion Strategic Consulting

We anticipate a market rate of return, starting with taking reasonable risks, such as holding a diversified investment portfolio.

A portfolio’s return will either exceed or fall short of the market’s, depending on how distinct it is from the overall market. This is what the investment industry refers to as “alpha.”

An investor needs to own a portfolio of stocks and bonds that outperforms the relevant market in order to generate a return higher than that of the market portfolio (a positive alpha). This can be accomplished in two ways: either by picking stocks or timing the market, neither of which is likely to produce consistently favourable results; or, more consistently, by overweighting sectors of the market that, according to academic research, reward investors for holding them over the long run, such as tilting toward smaller and value-oriented companies.

Next, the outcome is reduced by the cost incurred in obtaining the desired answer. It makes sense to keep financial expenses under control.

Ultimately, poor investing decisions come with a price, including the possibility of succumbing to delusions, prejudices, or incomplete knowledge. Such a cost can be avoided with solid methods and discipline, together with additional support from a competent financial consultant.

Investors can minimize their emotional stress and increase their chances of a profitable investment outcome by following a well-considered, evidence-based, and methodical investment procedure. Given the volatility of the markets, it cannot ensure that the result will always be favourable. It does, however, assist us in making sound judgment calls and avoiding the careless errors that frequently end up costing us a great deal of money. Specifically, following markets and managers in an attempt to outperform the market and falling victim to the newest investment craze propagated by news coverage, believable marketing narratives, and current patterns. The upshot of poor or non-existent process is largely dependent on chance rather than assessment.

Wise Words to Leave You With

Maybe take a moment to consider these insightful remarks made by Charles D. Ellis in his wonderful book “Winning the Loser’s Game” (Ellis, 2002):

“‘The hardest work in investing is not intellectual, it’s emotional. Being rational in an emotional environment is not easy. The hardest work is not figuring out the optimal investment policy; it’s sustaining a long-term focus at market highs or market lows and staying committed to a sound investment policy. Holding on to sound investment policy at market highs and market lows in notoriously hard and important work, particularly when Mr. Market always tries to trick you into making changes.”

Easy but not simple. The secret to success is a methodical approach and your adviser’s helping hand.