Table of Contents

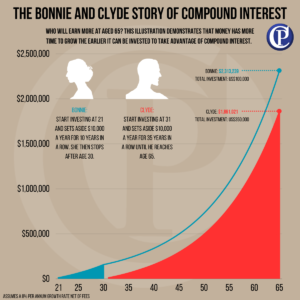

Question: Who will accumulate the largest pot of money aged 65, assuming 8% investment growth? Bonnie who saves for 10 years from 21 to 30 then decides to cease paying into her savings vehicle or Clyde, who starts to save from 30 to 65 for 35 years having had an extended ‘’gap year’’?

The answer is Bonnie, though she invested 30% less than Clyde’s total investment but had a 10-year head start. How is this possible?

The great Albert Einstein allegedly called this the eighth wonder of the world. Compound Interest or Compound growth.

‘He who understands it, earns it, he who doesn’t, pays it’

Simple & Compound Interest

Compound interest is a fundamental concept in financial planning that can significantly enhance your savings over time. There are two types of interest you should know about. Simple and compound.

Unlike simple interest, which is calculated only on the initial principal, compound interest accrues on both the principal and the accumulated interest. This means that as you save regularly, your money grows at an increasing rate. For instance, if you invest $1,000 at an interest rate of 5% compounded annually, after 20 years, you could have over $2,600 without additional contributions. Compound doesn’t simply occur annually; it can also occur on a quarterly basis or even a monthly basis.

Understanding how compound interest works empowers you to make informed decisions about your savings strategy. By starting early and contributing consistently, you can harness the power of compound interest to achieve your long-term financial goals, making it an essential element of effective financial planning.

Benefits of regular service

Regular savings play a crucial role in effective financial planning, providing a foundation for long-term wealth accumulation. Regular savings leverages the benefits of compound interest, which accelerates growth over time. When you contribute consistently, you not only increase your principal but also enhance the interest earned on previous savings. This creates a powerful snowball effect.

Additionally, regular savings instils financial discipline, helping you develop a habit of setting aside money for future needs, emergencies, or investments. It also provides a safety net, ensuring you are prepared for unexpected expenses. By prioritising regular savings, you establish a solid financial base, enabling you to achieve your goals such as buying a home, funding education, or enjoying a comfortable retirement. Ultimately, consistent saving is a key strategy in your overall financial planning strategy.

Bonnie vs Clyde

Meet Bonnie and Clyde, two friends with different approaches to financial planning. Bonnie begins saving $10,000 per year when she turns aged 21. After 10 years, she accumulates over $100,000, thanks to the power of consistent saving and compound interest. In contrast, Clyde opts to save later, at aged 31, contributing the same amount at $10,000 per year.

Bonnie stops contributing at 30 but continues to let her investments grow at 8%. Clyde, also invests in the same investment account, growing at 8% but he invests for 35 years instead of Bonnie’s 10 years.

Both at aged 65, Clyde would finish with an amount just over $1.5 million. Whereas Bonnie ends up with over $2.3 million.

Bonnie’s disciplined approach demonstrates how regular savings can significantly enhance financial growth through compounding. This example highlights the importance of consistent contributions in financial planning. By prioritising regular savings, Bonnie effectively leverages compound interest, showcasing how anyone can build a secure financial future with commitment and strategy.

Tips for Staying Committed To Regular Savings

Staying committed to regular savings is essential for effective financial planning. First, automate your savings by setting up an automatic transfer from your checking to your savings account. This ensures you save consistently without having to think about it. Most investment accounts have the ability to create a DDA which links your bank account. Of course, saving in the way described above via a bank account is highly likely to be sub optimal.

Second, create specific savings goals, whether it’s for an emergency fund, a vacation, or retirement. Clear objectives motivate you to stick to your plan. Third, track your progress regularly; seeing your savings grow can boost your commitment.

Finally, review and adjust your budget to prioritise savings. By incorporating these strategies, you will cultivate a strong habit of saving regularly, harnessing the power of compound interest to achieve your financial goals. Remember, consistent savings are a key pillar of successful financial planning.

Reading the news can affect your commitment. Listening to market updates can cause stress and you could possibly think about not investing this month as its ‘not the best time’. Sticking to a regular plan, creates a stress-free habit. Read more about timing the market in our article here.

Dollar cost averaging plays a big role in compound interest. Watch this space for an article on this later.

By understanding how compound interest (or growth) works, you can maximise your savings and watch your money grow exponentially over time. The above illustration doesn’t take into account inflation, but we like to remind our clients, with inflation, they should also think about increasing their contribution in line with inflation. By following tips to stay committed, such as automating your savings and setting clear goals, you can build a robust financial future.