Table of Contents

The temptation to outsmart the stock market by perfectly timing investments is strong for many investors. The dream of buying low and selling high is an alluring one. However, market timing is widely considered one of the riskiest strategies in investing, frequently leading to disappointing outcomes rather than the promised profits.

In this guide, we’ll explore why financial experts consider attempting to time the market a fool’s errand.

Historical evidence against market timing

Regarding the investment part of financial planning, historical data consistently shows that market timing is an ineffective strategy. Numerous studies have demonstrated that attempting to time the market more often than not leads to underperformance compared to a buy-and-hold approach.

A landmark study by Dalbar Inc. found that over 20 years, the average investor significantly underperformed the S&P 500 due to poor decision-making, including market timing.

Even professional money managers, with their vast resources and expertise, have struggled to consistently time the market successfully. This is proven by the SPIVA scorecard. As of 31st Dec 2023, only 12.02% of funds outperformed the S&P500 over 15 years. This historical evidence underscores the importance of focusing on long-term financial planning strategies rather than short-term market movements.

For effective financial planning, experts recommend adopting a disciplined investment approach, such as dollar-cost averaging and regular portfolio rebalancing, instead of trying to outsmart the market.

Try out this ‘time the market’ game and see if you can beat the market 9 times out of 10. How stressful were you when trying to time when to sell and when to buy back into the market? This is the emotional rollercoaster associated with timing the market, as further reviewed below.

Emotional pitfalls of market timing

Whether you’re new to investing or a seasoned trader, understanding the pitfalls of market timing is crucial for building a solid, long-term investment strategy.

When it comes to financial planning, emotions can be your worst enemy, especially when attempting to time the market. Fear and greed, the two most powerful psychological forces, often drive investors to make irrational decisions that can severely impact their long-term financial goals.

Fear: The Panic Seller’s Pitfall

Fear is a powerful emotional trigger that can wreak havoc on your financial plan. During market downturns, many investors experience:

- Loss aversion – Anxiety about potential losses

- Panic-induced selling, often at the worst possible times

- Hesitation to re-enter the market, missing out on recoveries

- Regret aversion – Can lead to hasty decisions to make up for past mistakes

- Attachment: Holding onto losing investments for too long due to emotional connections

Greed: The Overconfident Investor’s Trap

On the flip side, greed can be equally detrimental to sound financial planning:

- FOMO (Fear of Missing Out) on bull markets can lead to overinvesting

- Overconfidence in one’s ability to pick winners may result in a lack of diversification

- Chasing performance often leads to buying high and selling low

- Excitement: Causing impulsive investments in “hot” trends

Cost of missing out on market gains

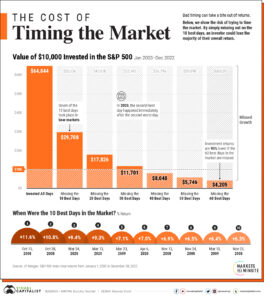

In the realm of financial planning, one of the most significant risks of market timing is the potential cost of missing out on substantial market gains. Research by JP Morgan revealed that investors who tried to time the market missed out on the best-performing days, dramatically reducing their overall returns. This highlights the importance of consistent market participation in achieving financial planning goals.

Source: Visual Capitalist, https://www.visualcapitalist.com/chart-timing-the-market/

Moreover, these best-performing days often occur during periods of high volatility or immediately following market downturns, precisely when market timers might be on the sidelines. By attempting to avoid losses, market timers frequently miss out on the rebounds that are crucial for long-term wealth accumulation.

For robust financial planning, experts recommend staying invested and focusing on time in the market rather than timing the market. Strategies like dollar-cost averaging and maintaining a diversified portfolio can help investors capture market gains while managing risk.

Stay tuned for next month’s common pitfall, where we will cover dollar-cost averaging and the Bonnie vs Clyde effect.

Efficient market hypothesis

The efficient market hypothesis (EMH) posits that financial markets are “informationally efficient” – asset prices already reflect all relevant information, making it impossible for investors to consistently outperform the market through stock picking or market timing. This has significant implications for financial planning.

If the EMH holds true, actively trying to “beat the market” is a futile endeavour. Instead, the prudent financial planning approach is to build a diversified portfolio of low-cost index funds that track the overall market performance. This passive investing strategy has been shown to outperform most active managers over the long term. By accepting market returns rather than attempting to time the market, investors can focus on other critical aspects of financial planning, such as asset allocation, saving diligently, and controlling costs. An efficient market mindset can lead to more effective, disciplined financial plans.

“It’s not about timing the market, it’s about time in the market.”

Don’t hesitate to ask for help when building a diversified, low-cost portfolio for your future long-term goals. To learn more about how we invest, click here. If you would like to book an initial meeting with one of our advisors, contact us.